How Check Stubs Can Help Track Tax Withholding Throughout the Year

Tracking tax withholding can be challenging, especially if you’re new to handling payroll or managing your finances. Yet, understanding how much you’ve paid in taxes throughout the year can simplify tax time, help with budgeting, and keep you from facing unexpected bills from the IRS. For employees, self-employed individuals, and business owners alike, check stubs provide an accessible way to stay on top of tax withholdings month by month. Let’s dive into how check stubs can make tax tracking easier and what you need to know to make the most of this essential financial tool.

What Is a Check Stub?

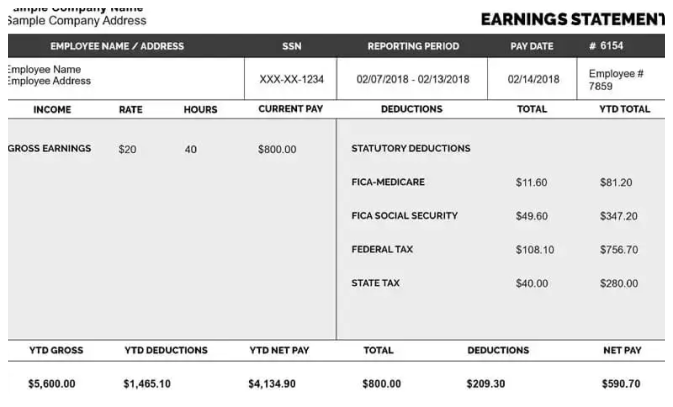

A check stub, also known as a pay stub, is a document that details the earnings and deductions associated with each paycheck. It breaks down gross pay (total earnings before deductions) and net pay (take-home amount after deductions) and lists any amounts withheld for taxes and other purposes. Check stubs usually include:

- Employee and employer information – Including names and contact details.

- Pay period dates – The start and end dates for the pay period covered by the check.

- Gross pay – The total amount earned before deductions.

- Deductions – Tax withholdings (federal, state, and local) and any other withholdings like Social Security, Medicare, and possibly insurance or retirement contributions.

- Net pay – The final amount after all deductions, or the take-home pay.

Each of these details helps employees understand where their money is going and offers a way to track tax payments.

The Importance of Tracking Tax Withholding

Tracking tax withholding is crucial to avoid surprises at tax time. Every paycheck, a portion of an employee’s income is withheld for federal and sometimes state or local taxes. By monitoring these withholdings through check stubs, individuals can understand if the right amount is being withheld each pay period.

- Helps Avoid Tax Surprises: By regularly checking stubs, employees can ensure they are paying enough in taxes to avoid a huge bill during tax season. On the flip side, if too much is being withheld, they might choose to adjust their W-4 to have more take-home pay each month.

- Aids in Budgeting: Since check stubs provide an itemized breakdown, employees can see exactly how much is going toward taxes and other withholdings. This clarity aids in budgeting because they know their actual take-home pay versus gross pay.

- Keeps Records Organized: Having a record of each paycheck’s withholding can be incredibly helpful if questions arise. Tax documents often require exact numbers that are available on check stubs, saving time during tax season.

How to Track Federal and State Tax Withholding with Check Stubs

When examining a check stub, employees should pay close attention to specific deductions that go toward tax obligations:

Federal Tax Withholding

Federal income tax withholding is based on an individual’s tax bracket and allowances claimed on their W-4 form. Employees can see the amount deducted per pay period for federal taxes on each check stub. This amount will accumulate over the year, making it easy to see the total federal taxes paid.

State and Local Tax Withholding

In addition to federal tax, many states require income tax withholding. Check stubs list these deductions separately, allowing employees to track their state tax contributions. In some regions, local taxes are also withheld, and these will appear on the check stub as well.

Using Check Stubs to Verify Withholding Accuracy

Mistakes in tax withholding happen more often than you might think, and it’s generally up to employees to catch them. Regularly reviewing check stubs helps employees verify:

- The correct tax rate is being applied.

- Any adjustments or errors in deductions, such as for Social Security and Medicare.

If an error is found, employees should report it to their HR or payroll department immediately to prevent issues at tax time.

Using Check Stubs to Adjust Withholding

Employees who realize they’re over- or underpaying in taxes may wish to adjust their withholding amount. This is done by submitting a new W-4 form to their employer. By looking at check stubs regularly, employees can gauge whether they need to:

- Increase withholding if they’re likely to owe taxes.

- Decrease withholding if they expect a substantial refund and would rather have a bit more in each paycheck.

Check Stubs for Self-Employed Individuals and Contractors

While traditional employees receive check stubs from their employers, self-employed individuals or independent contractors must create their own. This is where tools like check stub generators can help. These generators allow self-employed individuals to keep a record of each payment they receive, detailing income, expenses, and taxes owed.

For independent contractors, check stubs also make tax preparation easier. Contractors must pay self-employment tax, covering Social Security and Medicare, and having organized records simplifies quarterly tax payments.

The Role of Check Stubs in Tax Deductions and Credits

Free Check stub also play a key role in determining eligibility for tax deductions and credits. Some deductions and credits are based on adjusted gross income, which can be estimated using the information on check stubs. Examples include:

- Child Tax Credit

- Earned Income Tax Credit (EITC)

- Dependent Care Credit

Tracking income and tax payments through check stubs ensures accuracy when applying for these credits or deductions.

Preparing for Tax Season with Check Stubs

When tax season rolls around, having access to all check stubs for the year can save employees and self-employed individuals valuable time and reduce stress. Check stubs provide nearly all the information required to complete tax forms, making it simple to:

- Calculate total earnings.

- Determine federal and state tax withheld.

- Document Medicare and Social Security contributions.

For those who use a tax preparer, having a year’s worth of check stubs on hand ensures that all tax-related income and withholding information is readily accessible.

Digitizing Check Stubs for Easy Access

Employees and freelancers alike can benefit from storing check stubs digitally. Many employers now offer digital access to pay stubs, and self-employed individuals can use a pay stub generator that stores copies online. Digitized stubs provide:

- Quick access when needed.

- Reduced clutter compared to paper copies.

- Security if physical copies are lost or damaged.

Whether they’re saved in a secure cloud drive or on a computer, digitized check stubs simplify tax filing and record-keeping.

Tools and Resources for Tracking Tax Withholding

Several resources can help simplify the process of tracking tax withholding:

- IRS Withholding Calculator: This free tool from the IRS lets employees adjust their W-4 based on estimated tax liabilities.

- Payroll Apps and Software: Many payroll providers offer apps that give employees real-time access to check stubs.

- Check Stub Generators: For freelancers and contractors, check stub generators make it easy to create records of income and tax payments.

With these tools, anyone can efficiently track tax withholding, simplifying year-end tax filing.

Why Small Businesses Should Offer Detailed Check Stubs

For small business owners, providing detailed check stubs to employees is more than just good practice – it helps them build trust with their employees by offering transparency. Small businesses that give employees access to detailed check stubs allow them to see their tax contributions clearly, making it easier to make informed financial decisions.

Conclusion

Check stubs are an invaluable resource for tracking tax withholding throughout the year. From avoiding surprises at tax time to helping with monthly budgeting, the information provided on check stubs empowers employees and contractors to take control of their financial health. Whether you’re an employee, self-employed, or a small business owner, understanding and using check stubs effectively can lead to better tax management and financial confidence year-round. So, next time you receive a paycheck, take a moment to examine your check stub closely – it might just save you time and money in the long run.