Virtual Number Improve Customer Support in Finance

What Are Virtual Numbers?

Virtual numbers are phone numbers that are not directly tied to a specific telephone line or device. Instead, they forward calls to existing phone numbers, whether landlines or mobile phones. This flexibility allows businesses to manage incoming calls efficiently without the need for extensive infrastructure. In the finance sector, this can translate into better accessibility and improved customer interaction.

Benefits of Using Virtual Numbers in Financial Customer Support

1. Increased Accessibility for Customers

Virtual numbers provide customers with a reliable means of reaching their financial service providers. Whether it’s inquiries about account balances, loan applications, or investment advice, having a dedicated virtual number ensures that customers can connect with support teams quickly and easily. By offering multiple virtual numbers for different services, companies can direct calls to the appropriate departments, reducing wait times and enhancing the overall experience.

2. Enhanced Professional Image

Having a professional-looking virtual number can significantly improve a financial institution’s image. Customers often associate dedicated lines with credibility and professionalism. For instance, a financial advisor who uses a virtual number can establish a more personal connection with clients while maintaining a polished image. This can lead to increased trust and, ultimately, better customer retention.

3. Improved Call Management and Tracking

Virtual numbers come with advanced call management features that allow financial institutions to monitor call volumes, track the origin of calls, and assess the effectiveness of different support channels. This data can provide valuable insights into customer behavior and preferences, enabling companies to tailor their services accordingly. By analyzing call patterns, businesses can also identify peak times for customer inquiries, allowing them to allocate resources more effectively.

4. Cost Efficiency

Implementing virtual numbers can be a cost-effective solution for financial institutions. Traditional phone systems often require significant investment in hardware and maintenance. In contrast, virtual numbers eliminate the need for extensive infrastructure, allowing companies to save on overhead costs. Moreover, virtual numbers typically come with flexible pricing plans, making them suitable for businesses of all sizes.

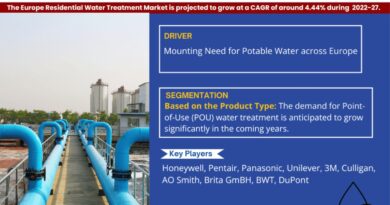

5. Global Reach

With virtual numbers, financial institutions can establish a presence in multiple regions without the need for physical offices. This is particularly beneficial for companies looking to expand their services internationally. By offering local virtual numbers in different countries, businesses can make it easier for customers to reach them, breaking down barriers to communication.

Best Practices for Implementing Virtual Numbers in Customer Support

1. Choose the Right Service Provider

Selecting a reputable virtual number service provider is crucial for ensuring seamless communication. Look for providers that offer robust features, competitive pricing, and reliable customer support. It’s essential to choose a provider that understands the unique needs of the financial sector.

2. Integrate with Existing Systems

To maximize the benefits of virtual numbers, integrate them with your existing customer relationship management (CRM) systems. This allows for a streamlined workflow, ensuring that customer interactions are logged and tracked efficiently. Integration can also provide valuable data insights to enhance customer support strategies.

3. Train Your Support Team

While virtual numbers simplify communication, it’s essential that your support team is adequately trained to handle inquiries effectively. Regular training sessions on best practices for using virtual numbers can help ensure that your team is prepared to provide top-notch customer service.

4. Promote Your Virtual Numbers

Ensure that customers are aware of your virtual numbers by prominently displaying them on your website, in emails, and through marketing materials. Clear communication about how and when to use these numbers can lead to increased usage and improved customer satisfaction.

Conclusion

In the competitive world of finance, providing exceptional customer support is essential for building lasting relationships with clients. Virtual numbers offer a versatile, cost-effective solution that enhances accessibility, improves call management, and bolsters a company’s professional image. By implementing best practices and leveraging the advantages of virtual numbers, financial institutions can significantly enhance their customer support capabilities, leading to increased satisfaction and loyalty.

As the financial landscape continues to evolve, adapting to new technologies like virtual numbers will be crucial for staying ahead. Don’t miss out on the opportunity to transform your customer support experience—embrace the power of virtual numbers today!

About Us:

SpaceEdge Technology appears to be a term that might refer to a company, concept, or technology related to space exploration or utilization. However, without further context, it’s challenging to provide specific information.

Read More.. https://nichenest.xyz/