Fundamental Analysis and Technical Analysis – Key Features

Fundamental Analysis and Technical Analysis – Key Features

Introduction

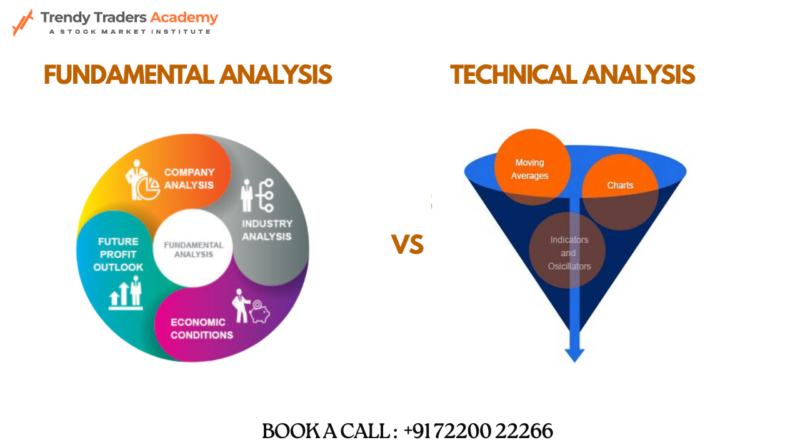

Ever wondered how traders predict market trends? Have you heard about Fundamental Analysis and Technical Analysis? These two widely used methods help investors analyze stocks and make informed decisions. While one focuses on a company’s financial strength, the other studies price trends and patterns.

Mastering these techniques can enhance your trading skills. Whether you’re new to trading or an experienced investor, understanding both methods can give you an advantage in the market. Let’s break them down!

Explore the key aspects of Fundamental and Technical Analysis. Learn how they impact stock trading. Enroll in best trading courses , stock trading courses India today!

What is Fundamental Analysis ?

Fundamental Analysis evaluates a company’s overall financial health before investing. It considers financial reports, earnings, revenue, industry position, and economic factors to determine a stock’s true value.

Key Aspects of Fundamental Analysis:

- Financial Statements (Balance Sheet, Income Statement, Cash Flow)

- Company Growth and Performance

- Industry and Market Trends

- Economic Indicators (Inflation, Interest Rates)

- Intrinsic Value Assessment

Fundamental analysts believe that a company’s actual worth influences its stock price in the long run.

What is Technical Analysis ?

Technical Analysis studies past price movements and trading volume to predict future trends. Traders use charts, indicators, and patterns to make informed decisions.

Key Tools in Technical Analysis:

- Candlestick Charts

- Moving Averages

- Support and Resistance Levels

- Momentum Indicators (RSI, MACD)

- Chart Patterns (Head & Shoulders, Double Bottoms)

Technical analysts believe that price movements follow trends and that historical patterns tend to repeat.

Key Differences Between Fundamental and Technical Analysis

| Feature | Fundamental Analysis | Technical Analysis |

| Focus | Company’s financial health | Price trends & charts |

| Timeframe | Long-term investment | Short-term trading |

| Tools Used | Financial reports, economic indicators | Charts, patterns, indicators |

| Approach | Value-based investing | Trend-based trading |

Both methods offer unique advantages. Many traders use a combination of both to improve their decision-making.

Key Features of Fundamental Analysis

- Evaluates intrinsic value – Determines if a stock is overvalued or undervalued.

- Long-term approach – Ideal for long-term investors.

- Relies on financial reports – Requires understanding financial statements.

- Influences stock valuation – Helps in making solid investment choices.

Key Features of Technical Analysis

- Focuses on price patterns and trends – Uses historical data to forecast future movements.

- Short-term trading strategy – Best suited for day traders and swing traders.

- Ignores company fundamentals – Relies only on market behavior.

- Uses technical indicators – RSI, MACD, and Bollinger Bands are widely applied.

When to Use Fundamental Analysis ?

Use Fundamental Analysis when:

- Investing for the long term (5+ years)

- Assessing a company’s growth potential

- Understanding broader market conditions

When to Use Technical Analysis ?

Use Technical Analysis when:

- Engaging in short-term trading (day trading, swing trading)

- Identifying the best entry and exit points

- Capitalizing on short-term price fluctuations

Which is Better for Beginners ?

For beginners, learning both methods is beneficial! Fundamental Analysis helps in selecting quality stocks, while Technical Analysis helps in timing trades effectively.

How to Learn These Analysis Methods ?

To master these techniques, consider enrolling in best trading courses , stock trading courses India online. Many platforms offer structured lessons, real-time market practice, and expert guidance.

Common Mistakes to Avoid

- Using only one method – A balanced approach is more effective.

- Ignoring market trends – External factors influence stock prices significantly.

- Overlooking risk management – Always use stop-loss strategies.

Final Thoughts

Both Fundamental Analysis and Technical Analysis are crucial in stock trading. While Fundamental Analysis helps determine what to buy, Technical Analysis helps decide when to buy. Combining both strategies can improve your trading decisions and increase your success in the stock market.

If you’re serious about trading, consider joining professional best trading courses to refine your skills and boost your expertise.

FAQs

1. Can I use both Fundamental and Technical Analysis together?

Yes! Many successful traders combine both methods for better investment decisions.

2. Which analysis method is better for long-term investors?

Fundamental Analysis is more suitable for long-term investments.

3. How long does it take to learn these analysis methods?

It depends on your dedication, but with a stock trading courses India, you can master the basics within a few months.

4. Do technical indicators always work?

Not always. No strategy is foolproof, as market conditions frequently change.

5. Where can I learn stock trading analysis?

You can join online best trading courses that provide in-depth training on both Fundamental and Technical Analysis.