How to Calculate Capital Growth: A Comprehensive Guide

Capital growth, also referred to as capital appreciation, is one of the primary ways in which investments increase in value over time. Understanding how to calculate capital growth is crucial for investors, as it helps them assess the performance of their investments and make informed decisions. Whether you’re investing in real estate, stocks, or other assets, knowing how to calculate capital growth will give you a clear picture of how well your assets are performing. In this blog, we’ll explain how to calculate capital growth and its importance in different types of investments.

What is Capital Growth?

Capital growth refers to the increase in the value of an asset over time. It is often measured as the difference between the purchase price and the selling price of an asset. For example, if you buy a stock for $1,000 and later sell it for $1,500, the capital growth is $500.

Capital growth is a key factor in determining the total return on an investment. In the context of property or real estate, capital growth means the rise in the property’s market value, while in the stock market, it refers to the increase in a stock’s price or the value of an investment portfolio.

Why is Capital Growth Important?

Capital growth is essential because it reflects the potential profitability of an investment. Investors seek capital growth as it leads to greater wealth over time. Unlike income-generating investments (such as dividend-paying stocks or rental income from real estate), which provide regular cash flow, capital growth is the main driver for long-term wealth accumulation.

Understanding capital growth allows investors to:

- Assess Investment Performance: Investors can track how well their investments are performing relative to the original purchase price.

- Make Informed Decisions: By understanding the rate of capital growth, investors can determine whether to hold, sell, or buy more of a particular asset.

- Plan for the Future: With capital growth projections, investors can plan their long-term financial goals more effectively, such as saving for retirement or funding education.

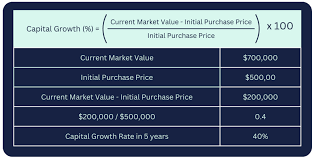

The Formula for Capital Growth

The formula for calculating capital growth is relatively straightforward. It involves determining the percentage increase in value of an asset over a given period of time.

Formula for Capital Growth:

Capital Growth=Final Value−Initial ValueInitial Value×100\text{Capital Growth} = \frac{\text{Final Value} – \text{Initial Value}}{\text{Initial Value}} \times 100

Where:

- Final Value refers to the value of the asset at the end of the investment period (e.g., after selling the asset).

- Initial Value is the price at which the asset was originally purchased.

This formula gives you the percentage growth in the value of the asset.

Let’s break it down with an example:

Example 1: Calculating Capital Growth in Real Estate

Imagine you bought a property for $300,000 five years ago. Today, the property’s market value is $450,000. To calculate the capital growth:

Capital Growth=450,000−300,000300,000×100=50%\text{Capital Growth} = \frac{450,000 – 300,000}{300,000} \times 100 = 50\%

The capital growth on your property is 50%, meaning the property has increased in value by half of the original price.

Example 2: Calculating Capital Growth in Stocks

Suppose you bought 100 shares of a company at $20 per share, and after 3 years, the price per share has risen to $30. The initial value of your investment was $20 × 100 = $2,000, and the final value is $30 × 100 = $3,000. To calculate the capital growth:

Capital Growth=3,000−2,0002,000×100=50%\text{Capital Growth} = \frac{3,000 – 2,000}{2,000} \times 100 = 50\%

Again, the capital growth on this stock investment is 50%, reflecting the increase in the value of your shares.

Compound Capital Growth

how to calculate capital growth just a one-time increase but involves continuous reinvestment and compounding over time. When you reinvest the capital gains into the same asset or another asset, you earn returns on your original investment as well as on the gains.

The compound capital growth formula is:

A=P(1+rn)ntA = P \left(1 + \frac{r}{n}\right)^{nt}

Where:

- A is the amount of money accumulated after n years, including interest or capital growth.

- P is the principal amount (the initial investment).

- r is the annual interest rate (decimal).

- n is the number of times that interest is compounded per year.

- t is the number of years the money is invested for.

The compound formula is helpful for long-term investments, such as in the stock market or bonds, where reinvestment plays a significant role in increasing the value of the investment over time.

Example 3: Compound Capital Growth with Reinvestment

Let’s say you invest $5,000 in a mutual fund that earns 6% annual capital growth, compounded annually. After 10 years, the value of your investment can be calculated as follows:

A=5,000(1+0.061)1×10=5,000×(1.06)10≈5,000×1.79085=8,954.25A = 5,000 \left(1 + \frac{0.06}{1}\right)^{1 \times 10} = 5,000 \times (1.06)^{10} \approx 5,000 \times 1.79085 = 8,954.25

After 10 years, your $5,000 investment would grow to $8,954.25, a capital growth of approximately 79.09%.

Factors That Affect Capital Growth

Several factors can influence the capital growth of an asset, including:

1. Market Conditions

The overall performance of the economy and specific industries or sectors plays a significant role in the growth of assets. For instance, in real estate, a booming housing market will likely lead to higher property values, resulting in more capital growth.

2. Inflation

Inflation erodes the purchasing power of money over time. If the capital growth rate of an asset does not outpace inflation, the real value of your investment might decrease, even though the nominal value increases.

3. Investment Horizon

The longer you hold an asset, the greater the potential for capital growth. For instance, stocks tend to perform better over longer periods, even though they may experience short-term volatility.

4. Risk and Return

Riskier investments tend to offer higher returns, and consequently, higher potential for capital growth. However, these investments also come with greater volatility, so it’s important to assess your risk tolerance when considering investments.

Conclusion

how to calculate capital growth is a vital tool for any investor, allowing you to evaluate the performance of your investments and make informed decisions. Whether you’re investing in real estate, stocks, or other assets, understanding the principles of capital growth will help you achieve your financial goals. By using the formulas and considering the factors that affect growth, you can more accurately assess your investment’s future potential and determine the best course of action.

Remember, while capital growth is a powerful way to accumulate wealth, it’s essential to consider factors such as market conditions, inflation, and your personal financial goals to make the best investment decisions.