How to Make Check Stubs Online: A Step-by-Step Guide

Creating check stubs online has become easier with the availability of free tools like paystub makers and pay stub generators. Whether you’re a freelancer, small business owner, or employee needing to manage your finances, these tools can streamline the process of generating accurate and professional-looking pay stubs.

Understanding Check Stubs

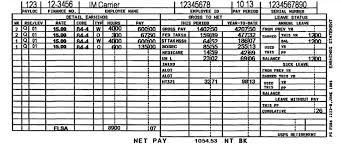

A check stub, also known as a pay stub or paycheck stub, is a document that outlines the details of an employee’s earnings and deductions for a specific pay period. It serves as proof of income and provides transparency regarding wages, taxes withheld, and other deductions.

Benefits of Using Online Tools

Using online pay stub makers and generators offers several advantages:

- Accuracy: Automatically calculates earnings, taxes, and deductions, reducing errors.

- Convenience: Accessible from anywhere with an internet connection, available 24/7.

- Customization: Tailor pay stubs to include specific information like bonuses, reimbursements, or deductions.

- Compliance: Ensures compliance with tax regulations and provides documentation for audits or financial inquiries.

Steps to Make Check Stubs Online

Step 1: Choose a Reliable Pay Stub Maker

Select a reputable online pay stub maker or pay stub generator. Look for features such as customization options, security measures, and user reviews to ensure reliability.

Step 2: Enter Employer and Employee Information

Provide essential details such as employer name, employee name, address, and employment status. Some tools may also require specific tax information depending on your country or state.

Step 3: Input Earnings and Deductions

Enter earnings for the pay period, including hourly wages, salary, overtime, bonuses, or commissions. Deductions may include taxes (federal, state, local), retirement contributions, health insurance premiums, and other withholdings.

Step 4: Customize Pay Stub Layout

Customize the pay stub layout to include additional information like pay period dates, employee ID, and employer contact information. Choose a template that suits your needs, ensuring clarity and professionalism.

Step 5: Review and Generate Pay Stub

Double-check all entered information for accuracy. Once satisfied, generate the pay stub. Most tools allow you to preview the stub before finalizing to ensure correctness.

Step 6: Download and Save

Download the generated pay stub in PDF format or as a printable document. Save copies for your records or send them directly to your email for easy access and distribution.

Using Free Pay Stub Generators

Free pay stub generators provide essential features without requiring payment. They are ideal for freelancers, small businesses, or individuals needing occasional pay stubs without incurring additional costs. Here are some key features to look for:

- Templates: Variety of templates to choose from, offering different layouts and designs.

- Calculators: Built-in calculators that compute taxes, deductions, and net pay automatically.

- Accessibility: Accessible online with no software installation required, compatible with various devices.

Benefits of Pay Stub Makers

- Financial Management: Helps in budgeting, tax planning, and tracking income over time.

- Professionalism: Provides professional-looking documents that are accepted for various financial purposes, including loan applications and rental agreements.

- Time-Saving: Automates the process of generating pay stubs, saving time compared to manual calculations.

Conclusion

Creating check stubs online using free tools like paystub makers and pay stub generators is a practical solution for individuals and businesses needing accurate financial documentation. By following the steps outlined in this guide and utilizing available resources, you can effectively manage your finances, ensure compliance with tax regulations, and streamline administrative tasks related to payroll. Whether you’re a freelancer managing multiple clients or a small business owner issuing pay stubs to employees, these tools provide the flexibility and efficiency needed to maintain organized financial records.