Why Retail Managers Should Use Check Stub Makers for Payroll Transparency

As a retail manager, one of your most important tasks is ensuring that your employees are paid accurately and on time. Managing payroll, however, can be a complex and time-consuming process. Whether you’re running a small boutique or a large retail chain, providing your team with clear and accessible pay information is vital to building trust and maintaining a positive workplace environment. One effective way to streamline this process is by using a check stub maker for payroll transparency.

A check stub maker is a tool that helps create professional, detailed pay stubs for your employees. These digital platforms have become increasingly popular for businesses of all sizes, especially in retail. But why should retail managers embrace this tool? Let’s explore the benefits, practical applications, and key reasons why incorporating a check stub maker into your payroll process can enhance transparency, increase efficiency, and improve employee satisfaction.

What Is a Check Stub?

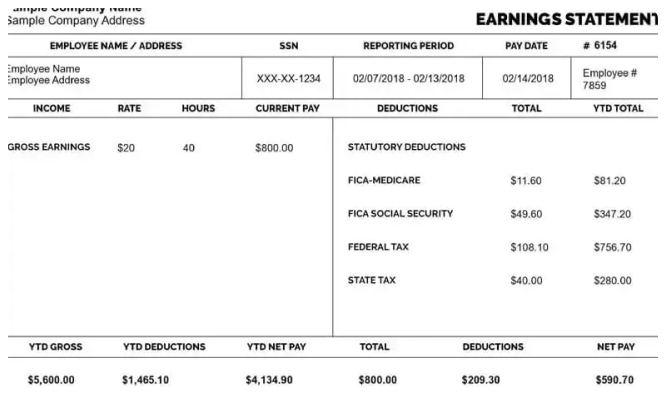

Before diving into why retail managers should use a check stub maker, let’s define what a check stub is. A check stub is a document that outlines the details of an employee’s paycheck. It includes information such as:

- Gross wages (the total amount earned before deductions)

- Deductions (for taxes, insurance, retirement, etc.)

- Net pay (the amount the employee takes home after all deductions)

- Employer information (business name, address, and contact details)

- Employee information (name, ID, position)

- Pay period (the time frame covered by the paycheck)

A check stub provides transparency for employees by breaking down their earnings, deductions, and contributions. It also serves as a record for both the employee and employer, which is helpful during tax season or if any disputes arise regarding pay.

Why Payroll Transparency Matters in Retail

In the retail industry, employees are often working varying hours, receiving overtime pay, or earning commissions based on sales. This can make payroll a complicated process. However, clear communication regarding pay is crucial. When employees don’t fully understand their paychecks or don’t have a clear breakdown of their earnings, it can lead to confusion, dissatisfaction, and even trust issues.

Here are a few reasons why payroll transparency is particularly important for retail managers:

- Employee Trust and Morale

Transparency in pay helps build trust between employers and employees. When workers know exactly how their paycheck is calculated, they feel more secure in their roles and are less likely to feel uncertain about discrepancies. Retail is a fast-paced, customer-focused environment, and trust in your leadership directly impacts employee morale and motivation. - Compliance with Labor Laws

Retail businesses need to comply with various federal, state, and local labor laws, which include regulations regarding overtime pay, minimum wage, and deductions. Check stubs make it easier to ensure compliance because they provide a detailed breakdown of how pay is calculated, helping you stay within legal requirements. - Accuracy and Preventing Errors

Payroll errors, such as incorrect hours, wrong tax deductions, or missing bonuses, can lead to frustration and even legal issues. By using a check stub maker, you can minimize human errors, ensure accurate calculations, and provide employees with an easy-to-read summary of their pay. - Improved Employee Retention

Employees who feel confident that they’re being paid fairly and transparently are more likely to stay with your business long-term. Clear pay stubs can prevent misunderstandings and create a positive work environment, contributing to better employee retention rates.

How a Check Stub Maker Improves Payroll Efficiency

As a retail manager, you already have a lot on your plate. Between overseeing inventory, managing customer service, and coordinating staff schedules, payroll may seem like just another task to check off. But inaccurate or delayed payroll can cause serious problems. By using a check stub maker, you can simplify the payroll process and save time while ensuring your employees receive the correct payment information.

Here’s how check stub makers can streamline your payroll:

- Automated Calculations

Check stub makers automatically calculate gross pay, deductions, taxes, and net pay based on the input data you provide. Instead of manually crunching numbers or using outdated software, these tools make calculations in seconds, reducing the risk of human error. - Customizable Templates

Check stub makers offer customizable templates that can be tailored to your business’s specific needs. Whether your employees work hourly, earn commissions, or receive bonuses, you can adjust the template to include the necessary information. This flexibility is particularly helpful in retail, where compensation structures can vary. - Integration with Payroll Software

Many check stub makers integrate with payroll software or accounting platforms, making it easier to sync data across systems. This integration eliminates the need for duplicate data entry, saving you time and reducing the risk of mistakes. - Cloud-Based Access

Many check stub makers are cloud-based, allowing you to access and store pay stubs securely online. Employees can view, download, or print their pay stubs anytime, which is especially convenient if you have remote workers or multiple locations. - Paperless Payroll

Going paperless with your pay stubs reduces the administrative burden of printing and distributing physical documents. It’s also better for the environment and can reduce costs associated with paper, ink, and storage. Paperless pay stubs are more secure, as they can’t be lost or misplaced.

Key Benefits of Using a Check Stub Maker for Retail Managers

Let’s take a closer look at the specific benefits that a check stub maker offers retail managers in particular:

1. Better Communication with Employees

Retail managers often juggle a diverse workforce, with part-time, full-time, and seasonal employees. A check stub maker ensures that each employee receives a clear, professional document detailing their pay. This can answer questions like:

- How are overtime hours calculated?

- What deductions are being made, and why?

- Is there an error in my pay?

Employees will appreciate having a pay stub that answers these questions in detail. Clear communication on pay ensures employees are informed and feel valued.

2. Faster Payroll Processing

Retail businesses may pay employees weekly or bi-weekly, and getting payroll done quickly and accurately is essential. A check stub maker reduces the time it takes to generate pay stubs, allowing you to process payroll in a fraction of the time. This leaves you with more time to focus on other important tasks, like managing staff or improving customer service.

3. Cost-Effective

Hiring a payroll specialist or using expensive payroll services can be costly for a small retail business. A check stub maker is an affordable tool that enables you to manage payroll without breaking the bank. Most check stub maker platforms offer flexible pricing plans based on the number of employees, which makes it an ideal solution for small and medium-sized businesses.

4. Data Security

Payroll data contains sensitive information that needs to be protected. Check stub makers offer secure cloud storage for pay stubs and other payroll records. This helps protect your business and employees from potential data breaches, theft, or unauthorized access. Moreover, many platforms offer encryption to keep sensitive data safe.

5. Tax Reporting Made Easy

For tax reporting and filing purposes, check stubs provide a clear record of all wages and deductions. In case of an audit or tax review, having detailed and accurate pay stubs can make the process smoother. With a check stub maker, you can ensure that all the necessary details are recorded for tax filing purposes.

Choosing the Right Check Stub Maker for Your Retail Business

When selecting a check stub maker, there are several factors to consider to ensure you choose the best tool for your retail business:

- Ease of Use

The platform should be user-friendly, even for those without a background in accounting or payroll. Look for a tool that simplifies the process with easy-to-follow instructions and intuitive features. - Customization Options

Ensure the check stub maker can accommodate your business’s specific payroll needs, such as overtime, bonuses, or commissions. Customization options are key to accurately reflecting your employees’ pay. - Integration with Other Software

If you already use payroll software or accounting platforms, look for a check stub maker that integrates with these tools. This can save you time and ensure that data is seamlessly transferred across systems. - Security Features

As payroll data is sensitive, make sure the platform offers strong security measures like encryption and secure login options to protect employee information. - Cost

While you don’t want to compromise on quality, make sure the cost of the check stub maker fits within your budget. Many platforms offer pricing based on the number of employees, so be sure to choose a plan that aligns with your business size.

Conclusion

In the retail industry, transparency is key to maintaining a positive relationship with your employees. By using a free check stub maker for payroll, retail managers can ensure that employees are well-informed about their pay, which helps build trust and satisfaction. The ability to automate payroll processes, customize pay stubs, and securely store payroll data makes check stub makers an invaluable tool for any retail business.

Implementing a check stub maker can save time, reduce errors, and improve overall payroll efficiency. Whether you’re a small retail store or a large chain, adopting this technology will enhance your payroll system, boost employee morale, and contribute to the long-term success of your business.