Step-By-Step Guide To Personal Finance For The Year 2025!

With every passing year, you are introduced to a new year packed with joy and fun learning. However, the fun is only one part, and you have to be ready with other aspects like finance, health, etc. This blog emphasises the personal finance aspect, which helps you grow and learn at the same time.

You can dive into the tips in the blog and bring wisdom and freedom to your finances. Create a scalable track that brings stability to your finances and make the right efforts on your way to personal finance.

You can manage from your budget to the subtle management of the guaranteed loans on the same day. Attain monetary betterment, and shape your future in the right direction. Even the smallest steps will take you ahead of the competition. You can craft your finances and boost your subtle financial management with the steps given below. Consider the step-by-step practices, and live a stress-free financial life in the year 2025.

Crafts your personal finance with subtle steps for the year 2025!

Step 1: Personalise your budget according to the new year:

You can personalise your budget a little more during the year according to the new year’s goals. Create your goals and restart your track by deleting the previous elements. Start fresh with new components or elements and begin a journey that will take you to new endeavours. Bring fresh things to your budget by researching it comprehensively and establishing your finances in the right direction.

With efficient personal finance strategies, scale and attain the right output for your growth. Use AI and advance your budget-making experiences. Create a track that ensures your monetary betterment and takes you to a stable state with efficient budget-making practices.

Step 2: Managing your educational expenses:

Everyone must keep spending on their education as knowledge gaps can create issues in meeting career demands. You can manage your educational expenses with the right programs and certifications, and you can obtain them with your efforts. You can manage your educational expenses with the right management of your funds.

Use your personal finances in a way that you can balance your educational money. Update yourself with the right courses, and move to a better world. Check out the new courses through the online aid and level up your learning experiences.

Step 3: Rewrite your savings and investment plan:

If you are also focusing on savings and investments, you can rewrite your savings and investment plan now. Looking at your plans helps you rewrite your goals. You can renew your plan and rebuild your goals. This step is to bring more stability to your future and indulge you in scalable steps for your career development.

Recreate your experiences and build yourself in the right direction. Hit the balance between your savings and investments and secure your future. Get new opportunities to finance for your work opportunities or financial emergencies. You can ease your future by raising your savings and investments and bringing better opportunities.

Step 4: Look out for promotions and get a hike in salary income:

You can check out the upcoming promotions and get a hike in your salary. This time, communicating with your manager is going to be good for getting a hike and managing all other expenses with a rise in savings and investment levels. Try not to adjust all your raises in salary income to fit your lifestyle. Instead, also raise your savings.

If your salary increases, avoid overspending and get closer to achieving your monetary wisdom. Making subtle decisions about money management will create a bright future ahead.

Step 5: Open new doors for business opportunities and earn higher:

If you are interested in starting your own business or scaling it higher, then you can open up new doors for business opportunities. Open new doors and earn higher with better-earning potential by integrating the right practices in your track. Make use of your prevailing skills, and even groom your skills with the right efforts.

Step 6: Manage your current debts with on-time repayments:

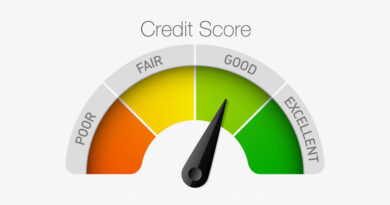

Your ability to manage your debts also helps you to grow faster. Avoid stacking in a debt trap, as it can be risky for your overall finances. Be on time to repay the loan, and do not borrow more than 30% of your total income. Maintaining such a financial percentage is important to attain financial wisdom and freedom.

Settle your debts faster and unlock new financing opportunities with ease. Get funds at lower interest rates and build your future in the right direction.

Step 7: Maintain your routine expenses:

You must also focus on maintaining your routine expenses. Check out your basic requirements, including your nutritional requirements, day-to-day expenses, etc. List such expenses and manage them to protect yourself from problems. Live a secure and healthy life with the subtle management of routine expenses.

You can create a diary of expenses that are personal to your goals. Your diaries will light up your future and add all the essentials in one place. Maintain your routine expenditures to boost your finances, and live a healthy life by focusing on your health, lifestyle, travel, entertainment, medical, and immediate needs.

Step 8: Upgrade your insurance plan:

Your insurance plan is a way to revive your finances. You can revive the plan by checking out the trending terms, which will make you more secure in the challenging world. Arrange a meeting with your insurance agent, and also research the critical aspects. Bring better results for your career, and manage your finances without struggling.

If you have to pay your premium amount and you lack money, you can adjust it now with guaranteed loans on the same day. Now, you can get GIG or a side hustle to repay your amount and not compromise with the routine expenses and financial goals. In such a way, you can get closer to financial brightening without facing issues.

Step 9: Maintain your emergency funds:

You must also maintain your emergency funds and keep investing in such an account. Get these funds and bring better responses to your financial track. Keep up with the challenging situations, and create your callable future.

The Bottom Note:

Check out the step-by-step guide to personal finance for the year 2025 and attempt to enjoy your financial management. Take care of your finances and elevate your performance as a borrower. Begin with the right steps to enjoy monetary success and add everything that brings comfort and shine to your track.

Take care of your finances as mentioned above, and you can achieve financial wisdom and success without meeting any obstacles. You can repay your debts within the given timeline and begin with small steps to your achievements. Brighten up your destiny with the right steps ahead, and also get better with the guidance you receive from financial advisers.

As suggested above, also manage your debt in a subtle way, as it may cause bad credit. Bad credit will affect your credibility and lower your performance as a borrower. Raise your financial capability and take the right steps to achieve financial fitness without stress.